How it works

No? No worries! We're all human. Thankfully, our tech isn't.

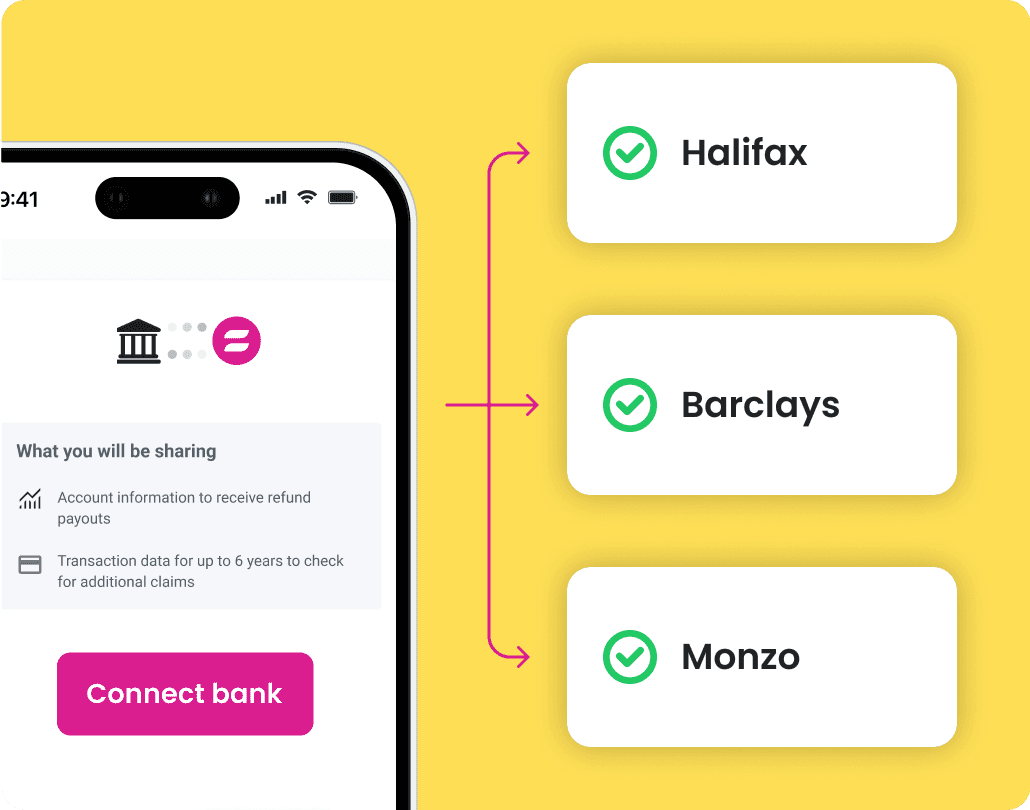

Connect your bank accounts

We securely access your financial history to see the full picture.

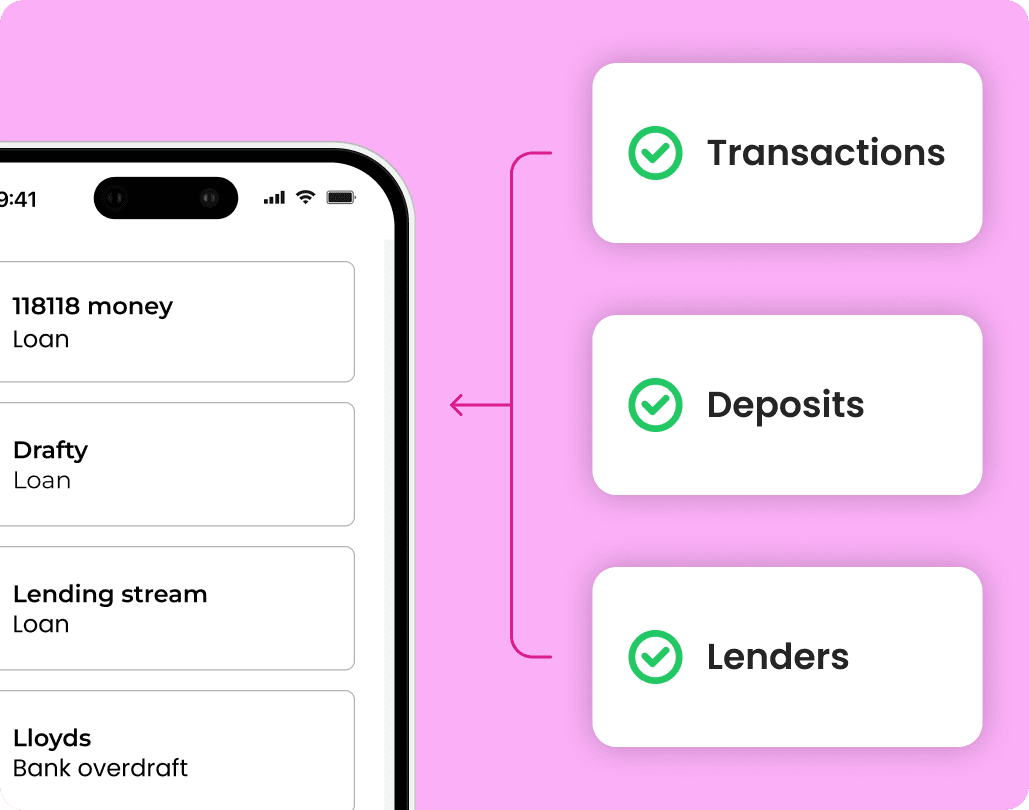

We gather the details

Our technology discovers, evidences and assesses potential cases of irresponsible lending.

You get outcomes

For each identified lender, we make one of three decisions straight away: No case, strong case or request data from lender. We'll then handle the rest and inform you of the time each one could take.

Join thousands who've already got back what is theirs.

Excellent company

They got me several thousands of pounds that I was owed and I had to do very little work. They took over from the start and were extremely helpful. Would highly recommend them.

– Charles, June 2025Very easy process

Very easy process and won the case and money I never thought I would get. Very happy customer.

– John, April 2025Would not hesitate to recommend

I saw this company from an ad on Facebook and I thought I’ve got nothing to lose. I was always kept informed and would not hesitate to recommend this company to anybody.

– Beverly, July 2025

*Data taken from average successful cases between 1st January 2025 - 30th September 2025 for loans and credit cards and from average successful cases managed by our sister company, Clear Legal Marketing Limited, between 1st January 2023 and 30th September 2025 for overdrafts. Figure represents the lower of the three respective average settlement values for loans (£1,006), credit card (£1,797) and bank overdraft (£2,104) claims.